There's a shift happening in how more youthful generations discuss cash. For Gen Z, the days of peaceful budgeting where funds were managed quietly behind closed doors are quickly fading. In its location, a bold, unapologetic pattern has actually arised: loud budgeting.

What exactly is loud budgeting? It's an activity that embraces economic transparency. It's concerning being vocal with your buddies when you can not afford a pricey dinner out. It's concerning choosing a much more affordable holiday and proudly describing why. It's budgeting with self-confidence and, most significantly, without embarassment. For Gen Z, loud budgeting isn't just a method, it's a kind of self-expression and empowerment.

Why Loud Budgeting Resonates with Gen Z

Gen Z has grown up in the darkness of significant financial events from the 2008 economic crisis to the pandemic economy. Much of them saw their moms and dads deal with financial debt, housing instability, or job insecurity. Because of this, this generation is hyper-aware of the importance of financial stability, however they're rewording the rulebook in just how they approach it.

They're not afraid to talk about their money goals. Whether they're paying off student finances, saving for their initial apartment, or contributing to a money market account, Gen Z thinks that financial conversations should be truthful and normalized. By turning budgeting into something you state out loud rather than hiding, they're getting rid of the stigma that so commonly features individual financing discussions.

This type of openness also creates accountability. When you inform your friends, I'm not investing added this month due to the fact that I'm saving for a cars and truck, it not just strengthens your monetary goal yet aids others appreciate your limits and maybe even motivates them to embrace similar habits.

Social media site and the Power of Financial Storytelling

Systems like TikTok and Instagram have played a big duty in magnifying this pattern. What might have as soon as been thought about private, like month-to-month spending breakdowns or net worth landmarks, is now cooperated brief video clips, economic vlogs, and candid inscriptions. These articles aren't flaunting riches; they're revealing what genuine finance appears like.

Gen Z isn't simply showing off what they can acquire. They're talking about just how much they save, exactly how they stay clear of debt, and what their monetary challenges are. There's something deeply relatable and inspiring concerning watching somebody your age clarify why they're meal prepping rather than getting takeout or how they're utilizing personal loans to combine bank card debt and minimize financial anxiety.

Loud budgeting, this way, becomes a type of community-building. It claims: You're not alone. I'm figuring this out as well. Which cumulative openness is one of the most empowering aspects of the activity.

The Influence on Spending and Saving Habits

Loud budgeting isn't simply talk, it's altering habits. Gen Z is embracing imaginative means to make budgeting work for them. They're challenging old norms regarding keeping up appearances or preventing looking damaged. Rather, they're redefining what economic toughness resembles.

That could imply freely selecting a side rush over happy hour. Or happily saying no to a fashionable technology acquisition since there's a bigger goal on the horizon. It's all about aligning everyday spending with lasting top priorities and being singing regarding it.

Lots of are likewise seeking devices and resources that sustain their objectives, from budgeting applications to versatile cost savings choices. Some are diving into the world of electronic go here envelopes or selecting to automate transfers into a money market account where their cost savings can grow while still staying available.

The result? A generation that's becoming more financially literate, intentional, and brave concerning handling their money by themselves terms.

Just How Loud Budgeting Shapes Conversations Around Debt

Among the most effective aspects of this trend is just how it's changing the story around financial debt. In previous generations, bring debt, especially customer debt, was frequently a resource of pity. It was kept quiet, covert under a refined exterior.

Gen Z, nonetheless, is reframing financial obligation as something to be understood, handled, and even discussed openly. They're sharing their trainee funding payoff trips, talking about the benefits and drawbacks of using credit cards, and clarifying exactly how they're leveraging personal loans for critical reasons, not out of desperation.

This type of sincerity produces space genuine conversations. It motivates smarter decision-making and lowers the anxiety and seclusion that often include monetary battles.

It also highlights the significance of having accessibility to banks that sustain these evolving requirements. While Gen Z may not comply with the very same economic path as their parents, they still seek stability, availability, and solutions that straighten with their objectives.

Loud Budgeting Meets Modern Banking Expectations

To sustain their lush budgeting lifestyles, Gen Z is searching for organizations that provide more than just checking accounts. They want education, empowerment, and useful tools that fit their mobile-first, always-on world.

This consists of adaptable economic items, digital comfort, and approachable guidance. Services like cooperative credit union business services are increasingly relevant, especially as several in Gen Z discover entrepreneurship or side hustles as a path to economic flexibility.

These individuals are not waiting until their 30s to construct monetary self-reliance. They're starting currently track their expenses, establishing objectives, and finding worth in organizations that listen and adjust to their values. Whether they're conserving, borrowing, or releasing a small company, they want to seem like partners in their economic journey, not simply account numbers.

The Future of Financial Empowerment Is Loud

Loud budgeting might have started as a personal money pattern, yet it's promptly ending up being a cultural change. It's about breaking down barriers, testing out-of-date cash taboos, and fostering much healthier, more educated relationships with money.

Gen Z is leading the cost not by claiming to have all of it determined, but by being take on enough to speak about the trip. They're establishing a powerful example wherefore it looks like to focus on financial health without apology.

And as this movement expands, so does the chance for every person, no matter age, to rethink exactly how we budget plan, invest, and conserve. Because the truth is, monetary clearness does not need to be quiet. Occasionally, the most responsible thing we can do is say it out loud.

Comply with the blog for more insights on financial empowerment, and check back on a regular basis for updates on just how today's cash practices are forming tomorrow's future.

Rick Moranis Then & Now!

Rick Moranis Then & Now! Alisan Porter Then & Now!

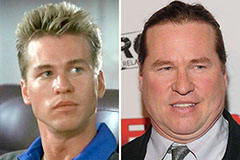

Alisan Porter Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Erik von Detten Then & Now!

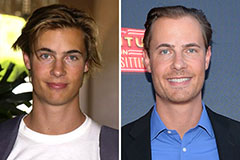

Erik von Detten Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!